All You Need to Know About Baby Bonus in Singapore

Baby Bonus Scheme

What is Baby Bonus?

The Baby Bonus Scheme is part of the Singapore Marriage and Parenthood Package. It aims to support couples in their decision to have children by reducing the financial cost of raising them.

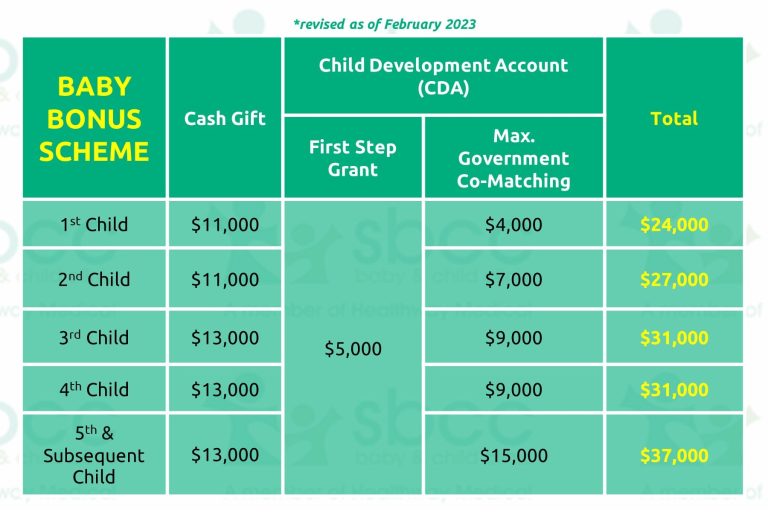

Benefits under the scheme include Cash Gifts and Child Development Accounts (CDA). You can join the Baby Bonus Scheme as early as 2 months before your child’s estimated delivery date by completing the Baby Bonus Registration Form.

Am I Eligible for Baby Bonus?

In order to be eligible for the Baby Bonus Cash Gift and/or CDA benefits:

- Your child must be a Singapore Citizen; and

- You must be lawfully married to your spouse

Use the Eligibility Check Tool to see if your child is eligible for the Baby Bonus Cash Gift and/or CDA benefits.

Baby Support Grant (BSG)

What is the Baby Support Grant (BGS)?

The Baby Support Grant (BSG) was introduced to support Singaporeans with their plans on starting their family during the COVID-19 pandemic. Expecting parents can receive a one-time Baby Support Grant of $3,000 if their child’s due date or estimated delivery date falls between 1 October 2022 and 13 February 2023 (extended from the previous delivery date of 1 October 2020 to 30 September 2022).

Am I Eligible for the Baby Support Grant?

Children who are already receiving the Baby Bonus Cash Gift are eligible for the Baby Support Grant. It will be deposited into the same bank account used to receive the Baby Bonus Cash Gift within one month of registration of Baby Bonus Scheme.

Babies born before 1 October 2020 with an estimated delivery date on or after 1 October 2020 can also receive the BSG if they are qualified for the Baby Bonus Cash Gift.

Parents will now receive up to $27,000 in cash and cash-like benefits for the birth of the first child aside from parental leave, subsidised education and healthcare benefits with the new Baby Support Grant.

If you need further assistance, please call the Baby Bonus hotline at 1800 111 2222.

How do I appeal for the Baby Support Grant?

Parents may email a scanned copy of your doctor’s certificate to msf_babybonus@msf.gov.sg for a review with these details:

- Estimated delivery date

- Mother’s name and identification number

- Name of clinic

- Doctor’s signature

Cash Gift (Baby Bonus Payout)

When will I receive my Baby Bonus Payout?

You may receive the first sum of the Baby Bonus Cash Gift (or Baby Bonus Payout) within 7 to 10 working days after the birth registration of your child, or after completing the online form, whichever is later.

The remaining will be given out in four instalments over the next 18 months. The Cash Gifts will be deposited into the preferred bank account specified on the Baby Bonus Registration Form and can be used to pay for your newborn’s expenses.

Child Development Account (CDA)

What is a CDA Account?

The Child Development Account is a special savings account created for your child. Singaporean parents may open their child’s Baby Bonus CDA account online at any of the approved CDA account banks (DBS/POSB, OCBC or UOB). The account will start within 3 to 5 working days after your child’s birth registration, or completion of the online form, whichever is later.

CDA account benefits are also available to children of single parents who are born, or have an estimated delivery date on/after 1 September 2016.

What is the First Step Grant?

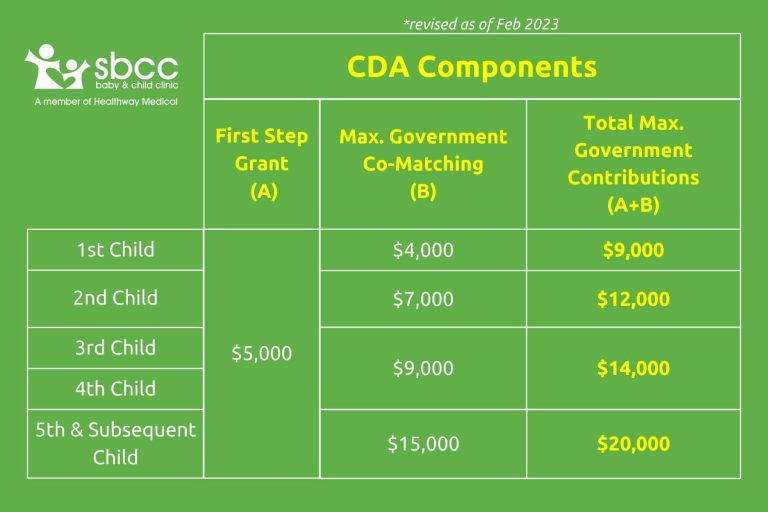

The First Step Grant of $3,000 is deposited automatically into your child’s CDA account upon the opening of the account, no initial saving is needed. Your future savings will subsequently be matched by the government, up to the co-matching cap, until your child turns 12 years old on 31 December of that year. The Government will match your savings within 2 weeks.

From 14 February 2023, the maximum government co-matching contribution for the second child (Singaporean) born on or after 14 February 2023 has been increased from $6,000 to $7,000.

Child Development Account Government Co-Matching Cap

What can the money in my child’s CDA Account be used for?

Your child’s CDA account savings can be used to pay for educational and healthcare expenses at any of the Baby Bonus Approved Institutions (AIs). Such usage includes:

- Fees for registered childcare centers, kindergartens, special education institutions, and early intervention programs

- Medical expenses at hospitals and general practitioner clinics such as our SBCC Baby & Child Clinic

- Premiums for MediShield Life or MediSave-approved private integrated plans

- Assistive technology devices

- Optical shops

- Approved items at pharmacies

What will happen to the savings in my child’s CDA Account after they turn 12?

Any remaining savings left in your child’s CDA account the year after your child turns 12 will be transferred over to their Post-Secondary Education Account (PSEA). Parents who did not manage to save up to the co-matching cap can keep contributing to the PSEA account and receive the matching amount until the cap is met or the child reaches the age of 18, whichever occurs first.

Baby Bonus One Stop Service Centre

Parents who require assistance in enrolling for the Baby Bonus online or completing other related e-services may visit the Citizen Connect Centres, or the Baby Bonus One-Stop Centres at the Immigration & Checkpoints Authority. You may also call the Baby Bonus hotline at 1800 111 2222 for assistance.

In Short…

Frequently Asked Questions

You can apply for your child’s Baby Bonus Scheme online at the Baby Bonus Portal. Simply follow the instructions for registration. You will be required to login with your Singpass to begin the enrolment. You may submit the form as early as 8 weeks before the child is born, or after the birth registration.

Check your child’s eligibility using the Eligibility Check Tool.

For more information on the registration process, watch this video.

During the online enrolment of your child’s Baby Bonus Scheme, select your preferred bank under “CDA Trustee’s Particulars”. Your child’s CDA account will be opened by your selected bank after a few days. You do not need to be physically present at the bank during this process.

If you or your spouse is a Singapore Citizen at the time of your child’s birth –

Your child will be eligible for the full Baby Bonus benefits. Your child must obtain Singapore Citizenship and join the Baby Bonus Scheme before reaching 12 years of age.

If you and your spouse are not Singapore Citizens at the time of your child’s birth –

Your child will be eligible for pro-rated benefits. Your child must obtain Singapore Citizenship before 24 months of age to be eligible for Cash Gift, and before 12 years old to be eligible for Child Development Account (CDA)

You can check your child’s eligibility and entitlement with the Eligibility Check Tool.

In order to qualify for the full Baby Bonus benefits, your child will need to obtain Singapore Citizenship by 12 years old. You can apply for your child’s Baby Bonus Scheme online at the Baby Bonus Portal.

If you and your spouse are not Singapore Citizens at the time of your child’s birth, your child will be eligible for pro-rated benefits. He/she must obtain Singapore Citizenship before 24 months old to be eligible for Cash Gift, and before 12 years old to be eligible for Child Development Account (CDA)